MENU

Latest Blogs

27th October 2021

Budget: Key business tax measures

The 2021 Budget included two key tax measures for SME businesses: The retention of the £1m annual investment allowance for capital expenditure, up to 31 March 2023, is to be welcomed and is a measure to encourage businesses to keep investing in new plant and machinery. The Budget also confirmed the Government’s commitment to R&D…

10th October 2021

Where is revenge spending?

As we are hopefully now at the start of the end for Covid related business activity disruption. The accounts of local SME’s are now starting to show part of the damage they have experienced through the lock-downs and associated restrictive measures. The overall effect upon turnover for the year-ends of 2020 has not been as…

2nd October 2021

Self Assessment late payment penalties

HMRC are now issuing six month late payment penalty notices, as the due date for 2019/20 tax payments was over seven months ago (includes consideration to the additional months extension as a result of the pandemic). Taxpayers facing financial difficulties due to the impact of COVID-19 may have entered into a time to pay arrangement…

1st October 2021

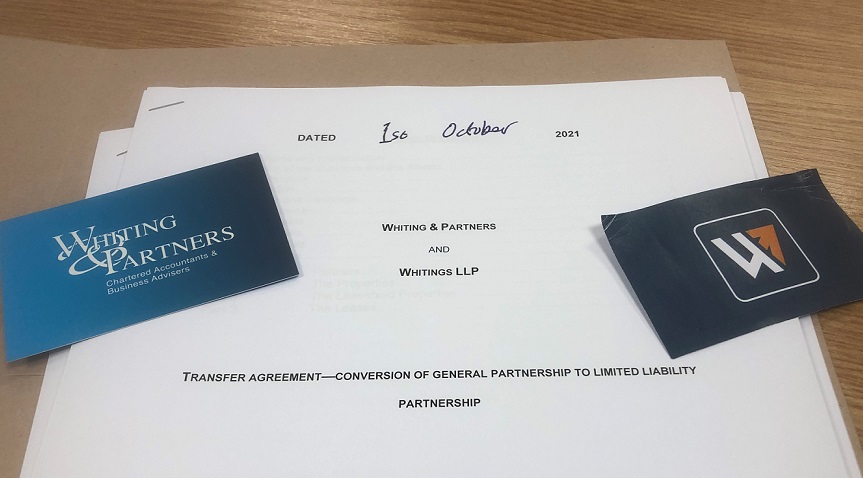

Whitings LLP Conversion

We are pleased to announce that we have today incorporated our practice into a limited liability partnership and shortened our business names from Whiting & Partners/Whiting & Partners Ltd to a unified Whitings LLP. As the world and our practice move forward, we have also modernised our branding and created a new group structure: …

23rd September 2021

MTD Delay

Making tax digital (MTD) for income tax is being delayed, originally due to come in from 6 April 2023 this has now been delayed. New proposed timetable: 6 April 2024: MTD for individual landlords with >£10k pa of rental income. 6 April 2025: MTD for general partnerships. No sooner than 2026: MTD for corporation tax.…

22nd September 2021

Net Zero Carbon: Does your business now need a plan?

From 1 October 2021, to be eligible to apply for public sector contracts over £5m pa, suppliers must have Net Zero Carbon Reduction Plans in place. These will be required to demonstrate a commitment to achieving Net Zero by 2050 in the UK: Taking Account of Carbon Reduction Plans in the Procurement of Major Government…

14th July 2021

Accounts Basis Period Reform – Consultation

Under current rules, businesses draw up annual accounts to the same date each year. The profit/loss for the tax year is usually the profit/loss for the year to the accounting date – called the basis period. Tax is paid on profits earned in the basis period ending in the tax year in question. However,…

15th June 2021

Tax on Cryptocurrency does not have to be cryptic

Within the last 10 years the cryptocurrency scene has exploded from the first decentralised cryptocurrency, Bitcoin, being created back in 2009 to now more than 4,000 different cryptocurrencies being in existence with a total market cap value of over £1trillion. This has led to the creation of the Cryptoassets Taskforce which was announced back…

14th June 2021

Deferred tax rate to increase

Deferred tax is a provision on the balance sheet for timing differences in tax and accounting treatment of certain items, and is measured at the rate of tax that the differences are expected to reverse in the future. In recent years, deferred tax has been measured at the current corporation tax rate of 19%,…

24th March 2021

Making Tax Digital – the next steps

Our MTD Group have produced Issue 5 of their newsletter giving details of Making Tax Digital (MTD) as it continues. So if you are unsure of what to do next, our newsletter has information and advice how to proceed. Don’t delay however as penalties will be introduced if submission deadlines are missed. Making…